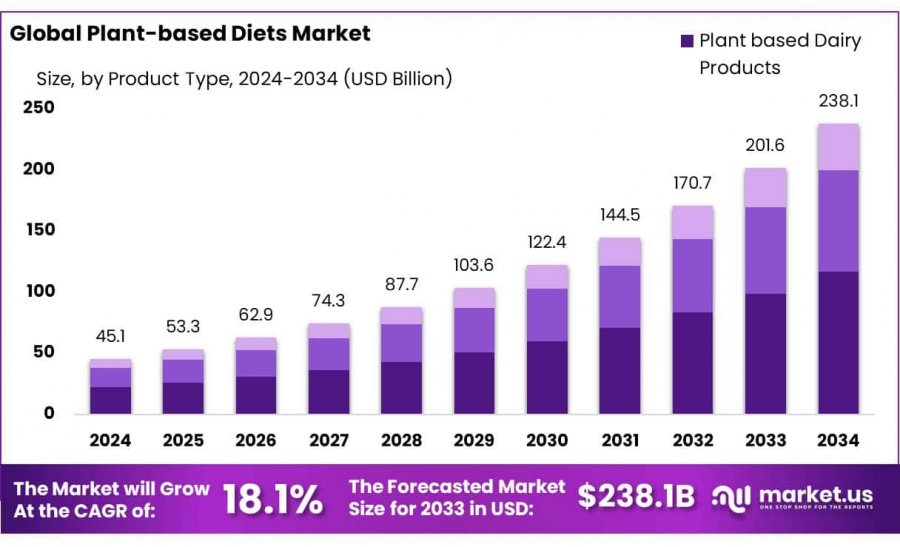

Plant Based Diet Market Size To Exceed USD 238.1 Billion by 2034, Growing at a CAGR of 18.1%

Plant-Based Diet Market size is expected to be worth around USD 238.1 Bn by 2034, from USD 45.1 Bn in 2024, growing at a CAGR of 18.1% from 2025 to 2034.

NEW YORK, NY, UNITED STATES, January 28, 2025 /EINPresswire.com/ -- The global Plant-based Diet Market Such expansion is indicative of a paradigm shift in consumer behaviors and dietary preferences, veering towards sustainability and health-conscious eating. Historically, the plant-based diet market has been driven by the burgeoning awareness of health benefits associated with a plant-centric diet, including reduced risks of chronic diseases such as heart disease, diabetes, and certain cancers.

Moreover, the increasing awareness of environmental sustainability issues, such as climate change and animal welfare, has significantly contributed to the consumer shift towards plant-based products. These factors have been instrumental in propelling the demand for plant-based foods across various regions, with particularly strong growth in North America and Europe, where there is a higher prevalence of health-conscious and environmentally aware consumers.

Companies are increasingly investing in research and development to diversify their product offerings to include a variety of plant-based dairy alternatives, meat substitutes, and other nutritional products. This innovation extends beyond mere replacements, aiming to enhance taste, texture, and nutritional value, thus broadening the appeal to a wider demographic, including flexitarians who occasionally consume meat.

Driving factors for the market include the expanding vegan and vegetarian populations, but significant growth also comes from the non-vegetarian consumers who are reducing their meat consumption, known as 'flexitarians'. This demographic shift is supported by the growing availability and accessibility of plant-based products in mainstream grocery channels, restaurants, and specialty stores, making it easier for consumers to integrate plant-based foods into their diets.

👉 Get a Sample Research PDF: https://market.us/report/plant-based-diet-market/free-sample/

Key Takeaways

• The Plant-Based Diet Market size is expected to be worth around USD 238.1 Bn by 2034, from USD 45.1 Bn in 2024, growing at a CAGR of 18.1%.

• Plant-Based Dairy Products held a dominant market position, capturing more than a 49.1% share of the plant-based diets market.

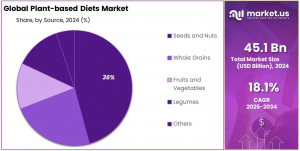

• Seeds and Nuts held a dominant market position, capturing more than a 35.7% share of the plant-based diets market.

• Supermarkets/Hypermarkets held a dominant market position, capturing more than a 46.3% share of the plant-based diets market.

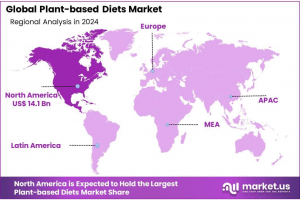

• North America dominated the plant-based diets market, holding a substantial share of 31.8%, valued at USD 14.1 billion.

Plant-Based Diet Statistics

• A 2023 survey found that approximately 3% of US citizens follow a vegan diet, while 5% are vegetarians.

• Nearly 40% of millennials identified as vegan in a 2018 survey, with Baby Boomers and Generation X tying at 21% each.

• Plant-based diets have been linked to a 15% lower risk of developing cancer, according to a 2017 study.

• Eating legumes regularly may reduce the risk of colorectal cancer by 9-18%.

• In a cross-sectional online survey of 315 respondents, 50% reported weight loss after adopting a plant-based diet, with a median loss of 6.4 kg.

Key Market Segments

By Product Type

In 2024, plant-based dairy products led the market with a commanding 49.1% share, underscoring the growing consumer shift towards dairy alternatives. This trend is largely fueled by increasing rates of lactose intolerance, a rising vegan population, and a broader consumer base adopting health-conscious eating habits. Within this category, plant-based milks like almond, soy, and oat milk have emerged as frontrunners, enjoying robust sales across both retail and food service channels.

By Source

Seeds and nuts dominated the source-based segments, accounting for over 35.7% of the market in 2024. The popularity of seeds and nuts is growing, driven by consumer recognition of their health benefits, including high levels of healthy fats, proteins, and essential vitamins. Commonly consumed as snacks, blended into smoothies, or used as ingredients in products such as plant-based milk, butter, granola, seeds, and nuts continues to see expanding market penetration.

By Distribution Channel

Supermarkets/Hypermarkets Dominate the Plant-Based Diets Market with a 46.3% Share in 2024 In 2024, supermarkets and hypermarkets emerged as the leading distribution channel for plant-based diets, accounting for over 46.3% of the market share. These retail outlets continue to be the preferred choice for consumers due to their extensive reach, convenience, and diverse product offerings.

In response to the rising demand for plant-based foods, supermarkets and hypermarkets have significantly expanded their dedicated plant-based sections. These sections now feature a broad range of products, including plant-based dairy alternatives, meat substitutes, snacks, beverages, and frozen foods, catering to the evolving preferences of health-conscious and environmentally aware consumers.

👉 Take Advantage of Up to 30% Off! https://market.us/purchase-report/?report_id=98842

Key Market Segments List

By Product Type

• Plant-based Dairy Products

• Plant-based Meat Products

• Others

By Source

• Seeds and Nuts

• Whole Grains

• Fruits and Vegetables

• Legumes

By Distribution Channel

• Supermarkets/hypermarkets

• Convenience Stores

• Specialty Stores

• Online

• Others

Emerging Trends

1. Sustainability and Ethical Packaging: By 2025, there will be a significant move towards using sustainable and vegan-friendly packaging materials. Innovations like compostable or even edible packaging options are becoming more prevalent, as consumers increasingly value environmental responsibility in their purchasing decisions.

2. Precision Fermentation: This technology is revolutionizing the plant-based sector by using microorganisms to produce proteins and molecules that mimic those in animal products. This innovation is especially impactful in creating plant-based cheeses and milk alternatives that closely resemble their traditional counterparts.

3. Focus on Local Superfoods: The trend towards local and sustainable superfoods is growing, with a shift away from imported exotic superfoods to more locally sourced options. This not only supports local agriculture but also reduces the carbon footprint associated with transportation.

4. Hybrid Proteins: The introduction of hybrid proteins that blend plant-based and lab-grown proteins is gaining traction. These products aim to offer optimal taste and texture, appealing to a broader range of consumers by closely replicating the sensory aspects of traditional meat.

5. Anti-Inflammatory and Personalized Diets: There's an increasing focus on diets that reduce inflammation and are tailored to individual health needs and genetic profiles. Foods rich in anti-inflammatory properties, like certain fruits, vegetables, and nuts, are becoming part of mainstream dietary recommendations.

Major Factors Driving the Growth of Hydrogen Peroxide Market

1. Health and Wellness Awareness: The growing consciousness about health and wellness is a significant driver. Consumers are increasingly aware of the health benefits associated with plant-based diets, such as lower risks of heart disease, diabetes, and certain cancers, which is pushing them towards adopting these diets.

2. Environmental Concerns: Awareness of the environmental impact of animal agriculture, which includes high greenhouse gas emissions and deforestation, is motivating consumers to switch to more sustainable plant-based foods. This shift is seen as a crucial step towards reducing personal and global carbon footprints.

3. Ethical Considerations: The ethical concerns regarding animal welfare are profoundly influencing consumer behavior. Many people are adopting plant-based diets to align with their values on animal rights and cruelty-free living, fostering market growth.

4. Innovations in Food Technology: Advances in food technology that improve the taste and texture of plant-based foods are making these products more appealing to a broader audience. Innovations, particularly in plant-based meats, have successfully mimicked the sensory attributes of animal meats, attracting not only vegans and vegetarians but also flexitarians.

5. Dietary Restrictions: The rise in dietary restrictions such as lactose intolerance and allergies to animal products is also propelling the plant-based food market. Plant-based alternatives are often seen as healthier options that cater to these dietary needs.

6. Expansion of Distribution Channels: The increased availability of plant-based products through various distribution channels, including major supermarkets, health food stores, and online platforms, has made it easier for consumers to access these products, significantly driving market growth.

Regulations On the Plant-Based Diet Market

1. Labeling Laws: In the United States, the absence of a unified federal approach has led states to develop their own regulations concerning the labeling of plant-based foods. Some states have introduced laws requiring plant-based products to include "imitation" labels if they resemble animal-based products, while others have faced legal challenges arguing these laws infringe on free speech rights.

2. Plant-Based Promotion Acts: The PLANT Act in the U.S. aims to make plant-based foods eligible for USDA assistance, encouraging the production of plant-based foods as part of a strategy to boost rural economies and sustainable food production.

3. Global Initiatives: Several countries are leading in plant-based food policies, incorporating incentives for plant-based food production into national policy frameworks. These policies are intended to foster sustainable eating habits and reduce the environmental impact of diets.

4. Nutritional Comparisons: The FDA has proposed regulations for plant-based milk that include voluntary nutritional comparisons with cow’s milk, recognizing the distinct nature of plant-based products without confusing consumers about their origins.

5. Research and Innovation Support: The PLANT Act also proposes supporting innovation in the plant-based food sector, recognizing the role of research in enhancing the quality and acceptance of plant-based foods.

Regional Analysis

North America held the largest market share in the global plant-based diets industry, accounting for 31.8% with a valuation of USD 14.1 billion. The region's market growth is primarily fueled by a strong demand for plant-based food and beverage alternatives, especially in the United States and Canada. Factors such as increased health awareness, environmental concerns, and a rising number of individuals adopting flexitarian diets have significantly contributed to the market's expansion.

Europe ranks as the second-largest market, demonstrating robust adoption rates of plant-based diets. The growth here is supported by a significant increase in vegan and vegetarian populations and is further enhanced by governmental policies aimed at promoting sustainability and reducing carbon emissions. The United Kingdom, Germany, and France are at the forefront of this trend, with ongoing innovations in plant-based food formulations by major companies.

Key Players Analysis

• Above Food Inc.

• Amy’s Kitchen Inc.

• Atlantic Natural Foods LLC

• Beyond Meat Inc.

• Conagra Brands, Inc.

• Danone SA

• DSM-Firmenich AG, Nestle S.A.

• Garden Protein International Inc.

• Glanbia PLC

• Impossible Foods Inc.

• Lightlife Foods Inc. (Maple Leaf Foods Inc.)

• Maple Leaf Foods Inc.

• Nestle S.A.

• The Hain Celestial Group, Inc.

• Tyson Foods Inc.

• Vbite Food Ltd.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Food & Beverage Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release