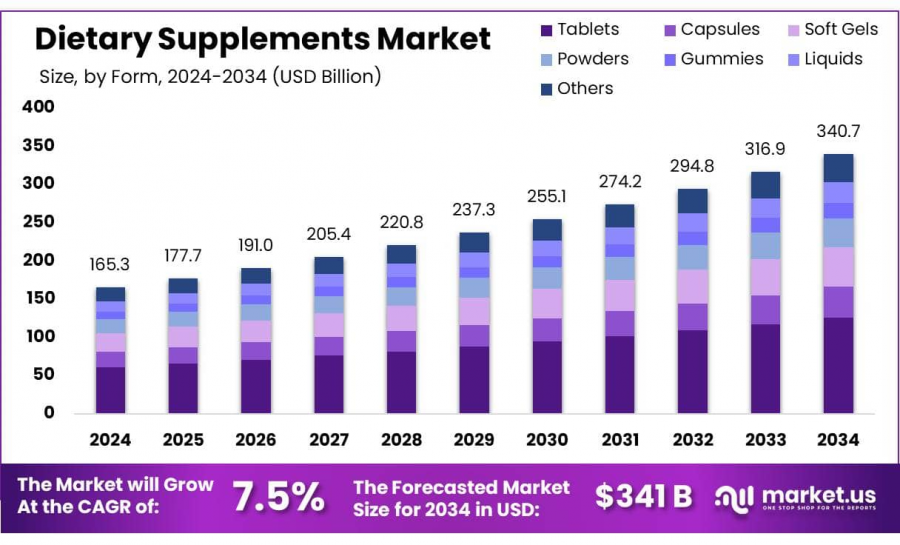

Dietary Supplements Market Projected to Reach USD 340.7 Billion by 2034, Growing at 7.5% CAGR

Dietary supplements market size is expected to be worth around USD 340.7 billion by 2034, from USD 165.3 billion in 2024, CAGR of 7.5% forecast 2025 to 2034.

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- Report Overview

Dietary supplements are products intended to complement the diet and provide essential nutrients, such as vitamins, minerals, amino acids, enzymes, and herbal extracts, that may not be adequately consumed through regular food intake. These supplements come in various forms, including tablets, capsules, powders, liquids, and gummies. They are widely used to support overall health, enhance immunity, improve athletic performance, and address specific nutritional deficiencies.

The dietary supplements market encompasses the production, distribution, and sale of various nutraceuticals that cater to different health needs and consumer preferences. This market is driven by growing health consciousness, aging populations, increased prevalence of lifestyle-related diseases, and demand for functional and organic products. The industry is expanding globally, with significant contributions from innovations in ingredient formulations, e-commerce growth, and regulatory advancements.

The increasing consumer focus on preventive healthcare and personalized nutrition is a significant growth driver for the dietary supplements market. Rising awareness of the benefits of dietary supplements, coupled with digital health trends and personalized diet plans, has fueled product innovation and market expansion. Additionally, advancements in biotechnology and ingredient extraction techniques have led to the development of highly bioavailable and functional supplements.

The demand for dietary supplements is fueled by a growing preference for natural and organic products, increased fitness consciousness, and the rising adoption of plant-based and vegan nutrition. Consumers are increasingly seeking targeted health solutions, such as immunity boosters, cognitive enhancers, and gut health supplements, leading to a surge in specialized formulations.

The market presents vast opportunities with the rise of digital and direct-to-consumer (DTC) sales channels. Personalized nutrition, AI-driven supplement recommendations, and the integration of wearables for health tracking are creating new avenues for industry players. Additionally, emerging markets in Asia-Pacific and Latin America provide untapped potential due to increasing disposable incomes and awareness.

Key driving forces behind market expansion include shifting consumer lifestyles, increasing geriatric populations, and government initiatives promoting dietary wellness. Additionally, strategic collaborations, product diversification, and aggressive marketing by key players further propel market growth. The growing influence of social media and influencer marketing also plays a crucial role in supplement adoption and awareness.

Get a Sample PDF Report: https://market.us/report/dietary-supplements-market/request-sample/

Key Takeaway

• The Dietary Supplements market size is expected to be worth around USD 340.7 billion by 2034, from USD 165.3 billion in 2024, growing at a CAGR of 7.5%

• Vitamins held a dominant market position in the Dietary Supplements sector, capturing more than a 38.40% share.

• Tablets held a dominant market position in the Dietary Supplements sector, capturing more than a 37.50% share.

• Supermarkets/Hypermarkets held a dominant market position in the Dietary Supplements sector, capturing more than a 48.30% share.

• Energy & Weight Management held a dominant market position in the Dietary Supplements sector, capturing more than a 33.50% share.

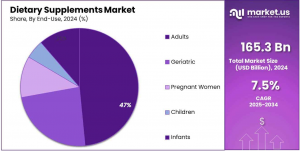

• Adults held a dominant market position in the Dietary Supplements sector, capturing more than a 47.30% share.

• Multivitamins are the most commonly used dietary supplements in the US, with over 50% of adults reporting their use.

• In 2022, the FDA warned consumers about the potential for certain dietary supplements to be tainted with undeclared and potentially harmful ingredients.

Dietary Supplements Market Segment Analysis

By Type Analysis

In 2024, Vitamins dominated the dietary supplements market with a 38.40% share, driven by rising health consciousness and their role in immunity and disease prevention. Botanicals gained popularity for their natural benefits, while Proteins & Amino Acids saw strong demand among fitness enthusiasts. Fibers & Specialty Carbohydrates and Omega Fatty Acids grew due to their cardiovascular and digestive health benefits. Prebiotics & Probiotics surged in demand, fueled by increasing awareness of gut health and its impact on overall well-being.

By Form Analysis

In 2024, Tablets led the dietary supplements market with a 37.50% share, valued for their convenience, precise dosage, and cost-effectiveness. Capsules followed, preferred for masking taste and protecting oil-based supplements. Soft Gels grew in popularity due to easy swallowing and fast absorption, especially for oil-based vitamins. Powders appealed to fitness enthusiasts for customized dosing. Gummies surged among younger consumers for their taste and chewable convenience, while Liquids gained traction for fast absorption, benefiting children and those with swallowing difficulties.

By Distribution Channel Analysis

In 2024, Supermarkets/Hypermarkets led the dietary supplements market with a 48.30% share, driven by convenience, variety, and competitive pricing. Online Platforms grew rapidly, offering home delivery and wider product access through major e-commerce sites. Pharmacies and Specialty Stores remained essential for expert advice and trusted brands, appealing to health-conscious consumers. Other channels, including direct sales and multi-level marketing, contributed smaller shares but remained relevant for niche supplement brands and wellness-focused buyers.

By Gender Analysis

In 2024, the women’s dietary supplements segment saw strong growth, driven by awareness of bone health, reproductive health, and menopause support. Calcium, iron, and folic acid remain popular, addressing changing needs across life stages.

Men’s dietary supplements also hold a significant share, focusing on heart health, muscle building, and energy support. Key ingredients include vitamins D and B12, zinc, magnesium, and omega-3 fatty acids, supporting testosterone levels and cardiovascular health. Rising fitness trends and proactive health approaches have boosted demand in both segments.

By Application Analysis

In 2024, Energy & Weight Management led the dietary supplements market with a 33.50% share, driven by rising fitness awareness and concerns over obesity and sedentary lifestyles. General Health supplements followed, fueled by preventive healthcare trends and demand for holistic wellness.

Bone & Joint Health, Immunity, and Cardiac Health segments saw steady growth, supported by an aging population and post-pandemic health consciousness. Consumers increasingly seek immune-boosting, joint-supporting, and heart-health supplements for long-term well-being.

By End-user Analysis

In 2024, Adults dominated the dietary supplements market with a 47.30% share, driven by a focus on preventive healthcare, fitness, and overall well-being. Popular choices include multivitamins, minerals, proteins, and stress-relief supplements.

The Geriatric segment saw strong demand due to aging populations addressing bone, heart, and cognitive health concerns. Pregnant Women also contributed significantly, as prenatal vitamins and minerals remain essential for maternal and fetal health. Rising awareness of nutritional support across all life stages continues to drive market growth.

Buy Now: https://market.us/purchase-report/?report_id=23802

Key Market Segments

By Type

• Vitamins

• Botanicals

• Minerals

• Proteins & Amino Acids

• Fibers & Specialty Carbohydrates

• Omega Fatty Acids

• Prebiotics & Probiotics

• Others

By Form

• Tablets

• Capsules

• Soft Gels

• Powders

• Gummies

• Liquids

• Others

By Distribution Channel

• Supermarkets/ Hypermarkets

• Pharmacies

• Specialty Stores

• Online Platforms

• Others

By Gender

• Women

• Men

By Application

• Energy & Weight Management

• General Health

• Bone & Joint Health

• Gastrointestinal Health

• Immunity

• Cardiac Health

• Diabetes

• Anti-cancer

• Others

By End-user

• Adults

• Geriatric

• Pregnant Women

• Children

• Infants

Top Emerging Trends

1• Rising Demand for Personalized Nutrition: Consumers are increasingly looking for dietary supplements tailored to their unique health needs, lifestyle, and genetic makeup. With advancements in AI and biotechnology, companies are now offering customized supplement solutions based on DNA testing, gut microbiome analysis, and personal health assessments. This shift towards precision nutrition is driven by the demand for more effective, science-backed formulations that cater to individual health goals, leading to greater consumer engagement and product innovation.

2• Growing Popularity of Plant-Based Supplements: The rise of veganism, sustainability concerns, and plant-based diets are fueling the demand for plant-derived supplements. Consumers prefer natural, organic, and clean-label products free from synthetic additives and animal-based ingredients. Plant-based protein powders, herbal extracts, and algae-based omega-3 supplements are gaining traction. Companies are investing in sustainable sourcing and eco-friendly packaging to appeal to environmentally conscious buyers, further driving the shift toward plant-based dietary supplements.

3• Expansion of Immunity-Boosting Products: The COVID-19 pandemic has heightened consumer awareness regarding immune health, leading to a sustained demand for immunity-boosting supplements. Vitamins C and D, zinc, elderberry, and probiotics have gained immense popularity. Functional foods and beverages infused with immune-supporting ingredients are also expanding the market. This trend is expected to continue as people prioritize preventive healthcare, making immune-supporting dietary supplements a core segment in the industry.

4• Digital Transformation & E-Commerce Growth: Online sales of dietary supplements are booming due to the convenience of direct-to-consumer (DTC) models and subscription-based services. Social media influencers, digital marketing strategies, and AI-driven recommendations are shaping consumer choices. Brands are leveraging e-commerce platforms to expand global reach, offer personalized shopping experiences, and provide detailed product education. The integration of digital tools in supplement retailing is transforming the industry, making it more accessible and data-driven.

5• Focus on Gut Health & Microbiome: Growing research on gut health’s impact on overall well-being has led to a surge in probiotic, prebiotic, and postbiotic supplements. Consumers are recognizing the link between gut microbiota and immunity, digestion, mental health, and metabolism. Companies are developing innovative formulations, including synbiotics (a combination of probiotics and prebiotics) and fermented supplements, to support optimal gut health. As scientific understanding of the microbiome expands, this trend is expected to remain a key driver in the dietary supplements market.

Regulations on the Dietary Supplements Market

In the United States, dietary supplements are regulated under the Dietary Supplement Health and Education Act of 1994 (DSHEA), which classifies them as food products. This classification means that, unlike pharmaceutical drugs, dietary supplements are not subject to pre-market approval by the Food and Drug Administration (FDA). Manufacturers are responsible for ensuring the safety and labeling accuracy of their products before they reach consumers.

The import and export dynamics of dietary supplements have also evolved. For instance, in the U.S., average exports increased by $10.2 billion from November 2023, while average imports rose by $25.0 billion in the same period.

In terms of revenue, companies like Vitabiotics have reported substantial profits. In 2023, Vitabiotics achieved profits of £55.2 million, marking a 9.5% increase from the previous year. The company also increased its dividend payout by 50% to £15 million in 2023.

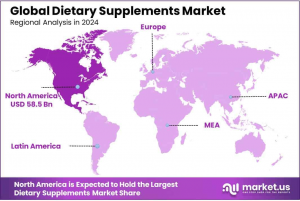

Regional Analysis

The global dietary supplements market is expanding, with North America leading at 35.40% market share, valued at USD 58.5 billion. This dominance is driven by high consumer awareness, personalized nutrition trends, and strong regulatory oversight by the FDA. The U.S. remains the largest consumer of dietary supplements.

Europe follows, with Germany, the UK, and France driving demand due to stringent EFSA regulations, rising health consciousness, and an aging population seeking preventive healthcare.

Asia Pacific is the fastest-growing region, led by China, Japan, and India, fueled by increasing disposable incomes, urbanization, and government initiatives promoting nutrition. China is a key hub for herbal supplements.

The Middle East & Africa sees steady growth, especially in Gulf countries, driven by wellness industry expansion. Latin America, led by Brazil and Mexico, is growing due to fitness trends and demand for natural supplements.

Key Players Analysis

◘ Nestlé S.A.

◘ Amway Corporation

◘ Abbott Laboratories

◘ ADM

◘ Pfizer Inc.

◘ Herbalife International of America, Inc.

◘ Nu Skin Enterprises, Inc.

◘ Nature's Sunshine Products, Inc.

◘ Bayer AG

◘ Glanbia PLC

◘ Sabinsa Corporation

◘ Sanofi S.A.

◘ NOW Foods

◘ Procter & Gamble

◘ Koninklijke DSM N.V.

◘ Other Key Players

Recent Developments of Dietary Supplements Market

— In 2023, Abbott Laboratories reported revenues of approximately $41.95 billion. The company continues to innovate in the healthcare sector, focusing on diagnostics and medical devices.

— In 2023, Bayer reported revenues of approximately $51.72 billion. The company remains a major player in the biomedical and health sectors.

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Food & Beverage Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release